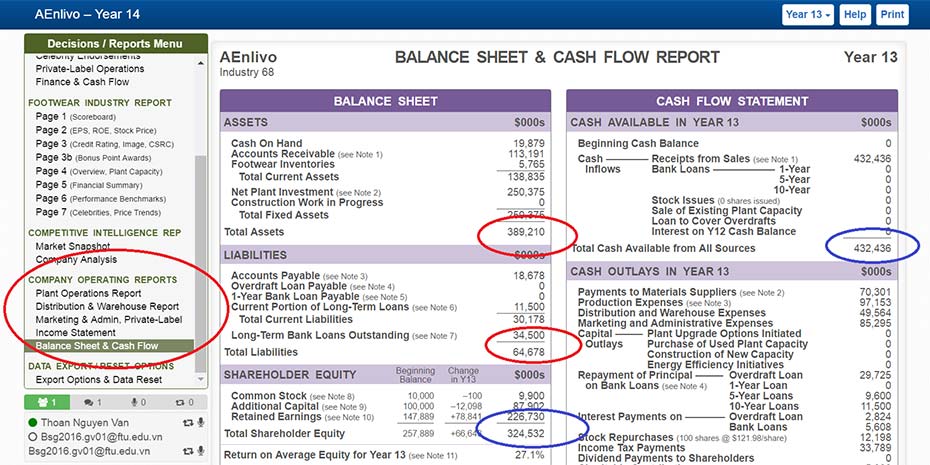

Finance and Cash Flow

We can use this table to make decisions about:

- Borrow new loans and pay off current debts, to increase Credit Rating. We can check current Debts and their Interest Rates in the Fianacial Report, Page 5

- We can scan all the details to see information about: Debts, Stocks, Repurchase Stock to increase EPS when we have lots of Cash, giving dividends to investors. We often give small sum, eg 0.1 for Year 11 and 0.2 for Year 12, increasing every year.

- We can borrow when we need money to expand factories.

When we do not have enough cash in hand, we need to borrow some in case we can pay the expenses, we need to pay high interest.

Looking at the report, we can get over view of all assets and liabilities of company, we can keep track of details inside Total Equity, then we can keep control of ROE. Do not expand to fast, otherwise Net Profit can not keep up with total Equity, the ROE can reduce.

We prefer high quality, because we can charge higher price, then we have more room to set price, and gain Higher Net Profit.

The other option is high volume, we have to build larger factories, in this case we will see total Equity is high. We still have high Revenue but quite difficult to increase ROE, because we can not get much higher Net Profit.

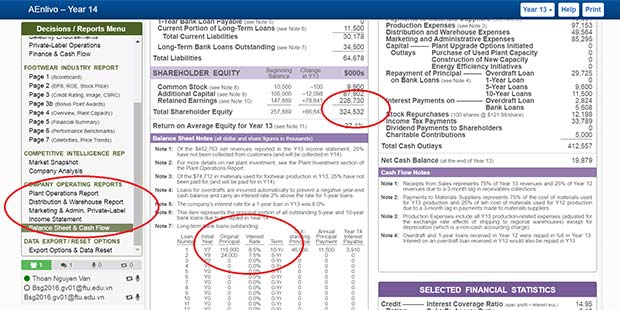

Check the total Equity from above table.

Check the Current Interest Rate from the above table

This is very powerful table, as it controls money, spend some time study, we can win the game by using this decision table in a good way.

Good Luck and Success!!